No extreme couponing. Just smart moves that add up.

Back when I first set the goal to save $10k in 12 months, I thought I’d need to move back in with my parents or win a small lottery. I was living paycheck to paycheck, ordering take out meals too often, and the idea of “cutting back” made me hesitant.

But here’s the truth: you don’t need to be rich, perfect, or a spreadsheet genius to save ten grand.

You just need a strategy that fits your life and a little consistency.

This post isn’t about deprivation. It’s about simple, sustainable adjustments that helped me (and can help you) save $10K in a year without losing your mind.

Table of Contents

Step 1: Know Your Magic Number ($833/month)

Let’s do some basic math:

- $10,000 ÷ 12 months = $833.33/month

- That’s about $27/day

This number matters because it turns your goal from vague to measurable.

If $833/month sounds impossible, don’t panic. You’ll see in a minute how we break it down into bite-sized wins.

Action Step: Write that number down. $833/month. That’s your new favorite benchmark.

Step 2: Do a 30-Minute Money Audit

Before you can save $10k in 12 months, you need to know where your money is leaking.

I resisted this step for months, thinking it’d be depressing. But when I finally sat down and started budgeting, I realized I was spending too much on subscriptions, impulsive Amazon buys, and excessive take-out meals.

Here’s how to do it:

- Look at your last 60 days of spending (check your bank or app)

- Take note of your needs (rent, utilities, groceries)

- Circle your wants (takeout, clothes, streaming)

- Add up the “want” column

That’s your opportunity.

If you haven’t noticed by now, I like food. I found $400/month in poorly-planned grocery runs. That’s $6K/year right there.

Step 3: Set Up a “No-Touch” Savings Account

You know the saying “Out of sight, out of mind?”. The same concept applies here.

Open a separate high-yield savings account that’s not linked to your main checking. I used Ally, American Express Savings or Capital One Savings – they both offer competitive APYs and zero fees.

Set up automatic transfers every payday. Even $100/week builds serious momentum.

Tip: Rename the account “$10K Goal” so every time you check, it feels like a progress bar, not just a bank balance.

Step 4: Cut $200–$300/month Without Suffering

If your goal is to save $10k in 12 months, you don’t have to live like you’re secluded from society. But you do have to cut intentionally.

Here’s where I trimmed:

- Paused subscriptions: Switched from ad-free to ad subscriptions for Hulu, Max, Prime Video, Spotify, and that meditation app I never used

- Cooked at home 4 nights/week: Saved $300/month

- Made coffee at home: $50/month saved

Total? Over $300/month saved without feeling deprived.

Mindset Shift: Cutting isn’t punishment. It’s prioritizing future-you over convenience.

Step 5: Pick 1 Side Hustle

You can only cut costs so much. The rest? You earn.

I tried a bunch of things on my road to save $10k in 12 months. Some flopped. Some paid off. But having an additional source of income definitely helps to accelerate your money goals.

Here’s what worked for me:

- E-commerce consulting: One client for $1,500/month

- Selling stuff on Facebook Marketplace: One-time $200

- Pinterest marketing gigs: Built from skills I already had

You don’t need a “six-figure side hustle.” You need $200–$500/month consistently. Stack that with your savings and you’re halfway there.

Action Step: Pick one money-making skill you already have. Offer it for 30 days. Track the income.

Step 6: Use a Budget That Doesn’t Make You Cry

Since your goal is to save $10k in 12 months, budgeting is important. However, if budgeting feels like a punishment, you won’t stick to it.

I’ve tried every method…spreadsheets, apps, cash envelopes – and here’s what finally worked:

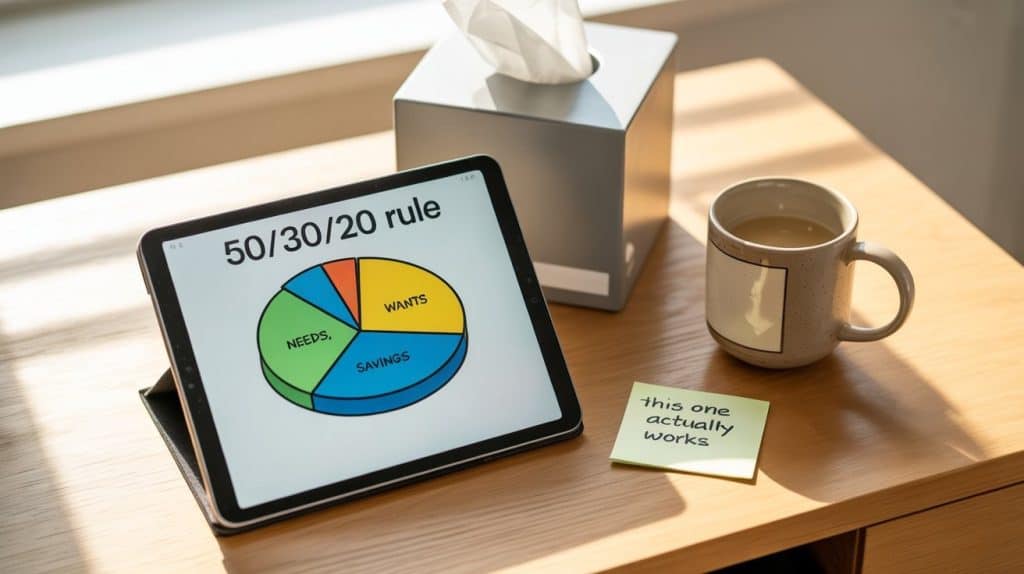

The 50/30/20 Rule:

- 50% → Needs (rent, groceries, bills)

- 30% → Wants (fun, dining out, etc.)

- 20% → Savings & debt payoff

You can adjust the percentages depending on your lifestyle. The point is: give every dollar a job before it disappears.

Step 7: Stack “Tiny Habits” That Add Up

Saving isn’t about one giant sacrifice. It’s about stacking small wins as you’re on your journey to save $10k in 12 months.

Here are some that helped me save an extra $50–100/month:

- Always bring a water bottle (no gas station impulse buys)

- Plan grocery runs with a list (saves $25 easy)

- Skip delivery fees by picking up food

- Unsubscribe from marketing emails (hello, impulse control)

Step 8: Track Progress Monthly (Not Obsessively)

The first time I saved $1,000 in one month, I almost spent it to “treat myself.”

Old habits die hard.

So I started tracking progress in a Google Sheet and treating it like a game.

Every $500 saved got a mini-reward like a guilt-free dinner or a new book. This helped me stay excited about reaching my goal to save $10k in 12 months.

This kept me:

- Motivated

- Consistent

- Less likely to self-sabotage

Tip: Celebrate progress. But do it strategically, not destructively.

Step 9: Get an Accountability Partner or Group

When I told a friend I wanted to save $10K in 12 months, he said, “Let’s do it together.”

Boom. Instant motivation.

We checked in monthly, shared wins/fails, and challenged each other.

It wasn’t serious. Just two people trying to grow.

You don’t need a coach or a financial planner. Just someone who cares.

Tip: If you don’t have anyone, start a private IG or TikTok account just for tracking your journey.

Step 10: Automate > Willpower

To save $10k in 12 months, you need more than willpower. Willpower is weak. Automation is undefeated.

And if you’ve ever tried to budget on vibes alone… you already know why this matters.

We all start strong. “This month, I’m going to save $500!”

But then rent is due, you’re tired, and your motivation dips. Suddenly, the money meant for your savings goal is gone and you’re telling yourself, “I’ll try again next month.”

That’s where automation saves the day. It removes your feelings from the equation.

Here’s what I automated:

- Savings transfers

- Credit card minimum payments

- Rent payment

- Side hustle invoices

- Budgeting reminders

Less decision fatigue = more consistency = more money saved.

You don’t need to work harder. You need to remove friction.

Final Thoughts: You’re Closer Than You Think

To save $10K in 12 months isn’t just about money, it’s about proving to yourself that you can set a big goal and actually follow through.

You don’t have to go broke, eat rice every night, or cancel your joy.

You just have to:

- Get clear about your goals

- Get consistent

- And get out of your own way

Start today. You will be glad you started sooner rather than later with $10K in the bank and proof that you can do hard things.

👉 Follow me on Pinterest for more tips on wealth, money and business!

Looking to Improve Your Money Skills? Learn More

- The Best Beginner Budgeting Apps to Try This Year

- Roth IRA Stock Investing Tips to Build Wealth

- How to Start the Half Payment Budget Method

- 12 Financial Goals to Build Wealth in Your 20s

- 12 Financial Goals to Build Wealth in Your 30s

- How to Lower Your Life Insurance Premiums

My Favorite Tools

To help you reach your financial goals, below are resources you can use to get started. They are free to sign up and will support your money goals.

Leave a Reply