How to Build Credit Fast Without Going into Debt

When you think about building credit, your mind probably jumps to debt. Credit cards, car payments, student loans – all the stuff people warn you about. The one thing I’ve been trying to figure out is how to build credit without going into debt.

And over the years I was able to figure out that you can definitely build good credit without racking up a ton of debt (or any at all). You don’t have to carry a balance, take on a loan, or sign up for things you don’t need just to see your credit score go up.

Did you know that insurance companies might do credit checks on you to determine your insurance premium? I didn’t believe it at first until I started hearing more about it from people online and people I interact with.

In this guide, I’ll show you some ways to build your credit history while keeping your bank account (and peace of mind) intact.

Table of Contents

What Is Credit and Why Does It Matter?

You probably already know this but your credit score is basically your adult report card. It tells banks, lenders, landlords, and even some employers (I know, sounds crazy) how trustworthy you are with money.

A friend of mine was in the finance industry and was applying for a management position at a major bank, and he told me they had to run a credit check on him.

A higher score means you have better chances of getting approved for things like apartments, credit cards, or a mortgage (with better interest rates too.)

Credit is based on five main factors:

- Payment history (35%)

- Amounts owed/credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

You can build your credit score by managing these categories responsibly without going into debt. Let’s talk about how.

1. Use a Credit Card (Without Carrying a Balance)

Yes, credit cards can help you build credit. And no, you don’t need to carry a balance or pay interest to see your score grow.

Here’s how to do it the right way:

- Open a beginner-friendly credit card (like a student or secured card – or even an intro-level unsecured credit card)

- Use it for small, regular purchases (gas, subscriptions like Netflix, groceries, etc)

- Pay off the full balance before the due date

Don’t use your credit card hoping to pay it back with “future money”, as in a future paycheck. These small expenses are manageable where you can pay them off with money already in your debit card.

This shows lenders you’re responsible with borrowing without falling into debt traps.

Example: When I got my first credit card, I set up auto-pay for my Spotify subscription. It was only $10/month (at the time), but over time, it helped create a perfect payment history and boosted my score.

2. Become an Authorized User on Someone Else’s Card

If have a trusted friend or family member with great credit and a long history with a credit card, they can add you as an authorized user. You don’t even need to use the card yourself.

Why this works: You benefit from their positive payment history and low credit usage, which reflects on your own credit report.

Important: Make sure the card issuer reports authorized users to the credit bureaus (most do). Also, make sure you fully trust this person! Their payment history will reflect on your credit score.

3. Apply for a Secured Credit Card (Optional)

If you’re brand new to credit or had issues in the past (bankruptcy, collections, etc), a secured card is a great option. You deposit a refundable amount (usually $200-$1,000), which becomes your credit limit.

Use it just like a regular card – small purchases, pay off in full each month and you’ll build credit without risking overspending.

Tip: After 6-12 months of on-time payments, most banks will upgrade you to a regular unsecured card.

4. Ask for a Credit Limit Increase (Without Increasing Spending)

This one’s sneaky but powerful. Increasing your credit limit can lower your credit utilization ratio, which is a big part of your score.

Let’s say:

- You have a $500 limit and spend $250 = 50% utilization

- Your limit goes up to $1,000, but you still spend $250 = 25% utilization

How to do it:

- Use your card responsibly for 3-6 months

- Ask for a limit increase via the bank’s app or customer service

- Don’t increase your spending just because your limit is higher

Note: Always ask your credit card company if a manual credit limit review is a ‘hard inquiry.’ If so, don’t do anything and just wait for their automatic increase.

5. Set Up Automatic Payments to Never Miss a Due Date

Payment history is the #1 factor in your credit score. Even one late payment can hurt your score and stay on your record for years.

Easy fix:

- Set up automatic payments for the minimum or full balance

- Use calendar reminders for due dates if you prefer manual payments

Tip: I created a separate checking account just for recurring bills and subscriptions linked to my credit card. That way, I always know I have money in there to cover payments.

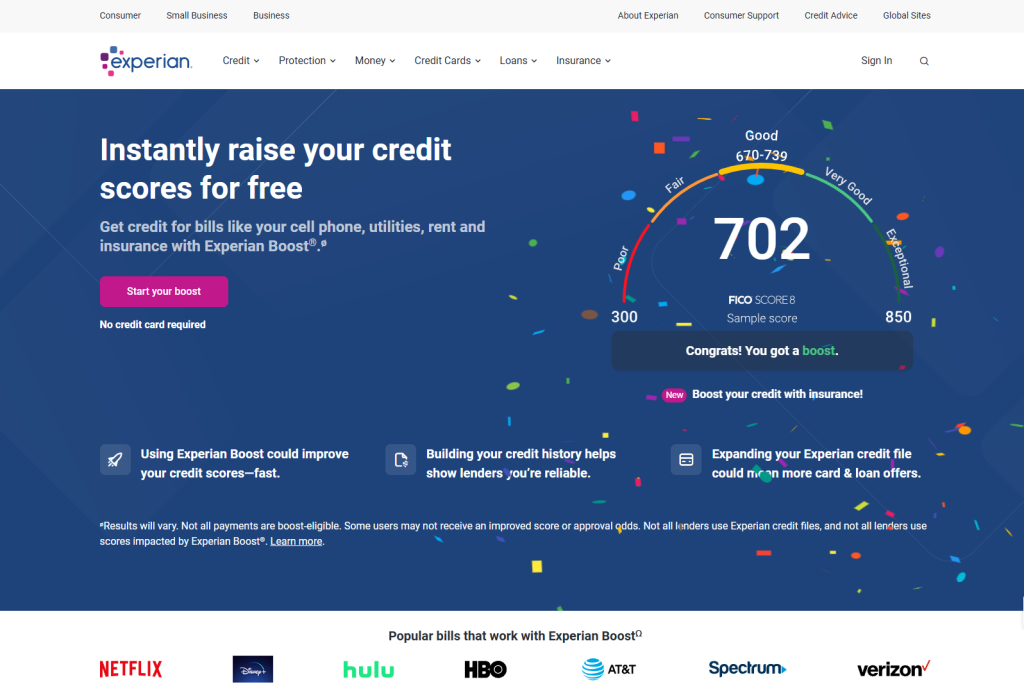

6. Use Experian Boost or Other Credit-Building Tools

Free tools like Experian Boost let you get credit for paying bills that normally don’t count – like utilities, phone plans, and streaming services.

How it works:

- Connect your bank account

- Experian reviews your payment history

- On-time payments get added to your credit file

This is great if you’re just getting started and want to show some positive payment activity.

Other tools to explore:

- Self (credit builder loans)

- Grow Credit (build credit with subscriptions)

7. Don’t Open Too Many New Accounts at Once

Every time you apply for new credit, it causes a small dip in your score (a hard inquiry). Too many applications in a short time can make lenders nervous. Why? Because it makes it seem like you’re in an urgent or desperate need for capital.

Be strategic:

- Space out new applications by at least 3-6 months

- Focus on one solid account at a time

- Avoid “credit card churning” unless you’re a seasoned pro

8. Keep Old Accounts Open (Even If You Don’t Use Them)

One of the easiest credit mistakes to make? Closing an old credit card. I know it might seem obvious to ‘streamline’ your cards and close them, but that’s the wrong move.

Even if you’re not using it, a long-standing account with a positive history helps your credit age and utilization.

What to do:

- Keep the card open

- Use it once every few months for a small purchase

- Set up auto-pay to keep it active without thinking about it

9. Monitor Your Credit Regularly

It’s easier to build good credit when you’re actually keeping an eye on it. Use free apps like Credit Karma.

They’ll alert you to changes, help track your progress, and flag any suspicious activity.

Bonus: These apps give you personalized tips to improve your score faster.

10. Don’t Stress About Perfect (Aim for Consistent)

You don’t need an 850 credit score to get approved for loans, apartments, or even a mortgage. What matters most is consistency.

A FICO score in the 700s will get you access to great rates and approvals without needing to obsess over every point.

Focus on:

- Paying on time

- Keeping balances low

- Using credit responsibly over time

FAQ

1. Can I build credit with a credit card without going into debt?

Yes! Use a credit card for small purchases and pay off the full balance each month. This builds a positive payment history without ever carrying debt or paying interest.

2. What’s the best way to start building credit with no credit history?

Start with a secured credit card or become an authorized user on someone else’s card. Both options help you build credit history safely and gradually.

3. Does paying bills help build credit without using a loan or credit card?

Some bills like rent, utilities, and subscriptions can count toward your credit if you use tools like Experian Boost.

Final Thoughts: Build Credit Your Way – Without Debt

Building credit without going into debt is 100% possible and honestly, the smarter way to do it. You want to approach Credit as a tool, not a trap. When used intentionally, it can unlock better opportunities without putting you at financial risk.

Stick to the basics:

- Use a card, pay in full

- Be on time, every time

- Monitor your score and progress

Whether you’re starting from scratch or rebuilding your credit story, these small habits will add up. Slow, steady, debt-free wins the race.

👉 Follow me on Pinterest for more tips on wealth, money and business!

Looking to Improve Your Money Skills? Learn More

- The Best Beginner Budgeting Apps to Try This Year

- Roth IRA Stock Investing Tips to Build Wealth

- How to Start the Half Payment Budget Method

- 12 Financial Goals to Build Wealth in Your 20s

- 12 Financial Goals to Build Wealth in Your 30s

- How to Lower Your Life Insurance Premiums

My Favorite Tools

To help you reach your financial goals, below are resources you can use to get started. They are free to sign up and will support your money goals.

Leave a Reply