I didn’t grow up frugal but I definitely learned fast. Between $70k+ in credit card debt, student loans, freelance uncertainty, and trying to build a business from scratch, I had to master the art of stretching every dollar.

What started out of necessity turned into something powerful: a frugal lifestyle that helped me feel in control instead of constantly behind.

So if you’re navigating tight budgets, trying to raise a family on a single income, or just want to stop leaking money, then this list is for you.

These are 50 simple frugal living tips that actually work. They are realistic enough for beginners, powerful enough for seasoned savers.

Table of Contents

50 Frugal Living Tips to Save More

1. Track every dollar for 30 days

Knowing where your money actually goes is the first win. Use a notebook, Google Sheet, or free app like Mint. You may think you know your spending, but seeing the numbers in black and white is eye-opening. It’s the foundation of any real savings plan.

2. Unsubscribe from marketing emails

Out of sight, out of cart. Sales emails are designed to trigger impulse spending. Removing that temptation helps you be more intentional about your purchases. You won’t miss the “20% off” if you weren’t planning to buy it anyway.

3. Switch to a cash envelope system

This classic frugal strategy limits your spending by category and it really works. Once an envelope is empty, that’s it for the month. It’s a powerful way to feel the weight of every dollar.

4. Do a pantry challenge once a month

Use up what you already have before buying more groceries. Saves money and reduces waste. It also pushes you to get creative with meals and try combinations you never thought of.

5. Shop with a grocery list (and never hungry)

Impulse buys thrive when you’re aimless or hungry. Having a list keeps you focused and within budget. Stick to the outer aisles where whole foods live.

6. Try one meatless meal per day

It’s cheaper, healthier, and stretches your grocery budget further. Think lentil soup, veggie stir-fry, or bean burritos. Plant-based meals can be hearty, delicious, and low-cost.

7. Embrace leftovers like a champ

Reinvent them as wraps, soups, or stir-fry. One meal becomes two. You save time, energy, and most importantly….money.

8. Set no-spend days (or weekends)

Create mini challenges: no money leaves your account for 24–72 hours. Use that time to enjoy free activities or knock out to-do list items. These breaks reset your spending habits.

9. Cancel subscriptions you forgot about

Check Apple, Google, PayPal, and your bank statement. Trim the fat. Even $10-$15 a month adds up when multiplied across multiple services.

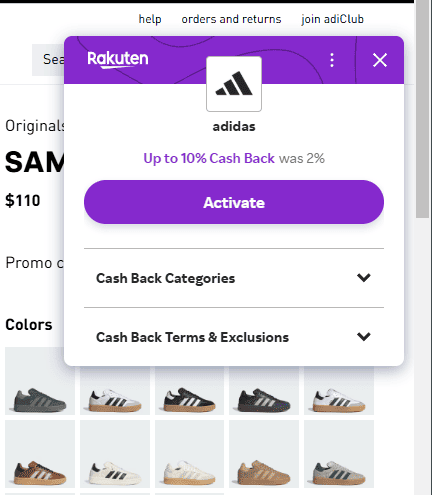

10. Use Rakuten or Honey for cashback

These browser extensions like Rakuten find hidden savings when you do need to buy online. They apply coupons automatically and kick back a percentage. Passive saving is the best kind.

11. Meal plan around what’s on sale

Look at the circulars first, then build your meals. This ensures you’re buying what’s affordable instead of just what you crave. It also helps reduce mid-week grocery runs.

12. Batch cook for the week

Prepping meals in advance keeps you out of the drive-thru line. It also saves time during busy weekdays. Your future self will thank you.

13. Buy generic or store brands

Most are made in the same factories as name-brand items. Compare labels and ingredients, they’re often nearly identical. The savings add up over time.

14. Cut your own hair (or your kids – if possible)

YouTube is full of tutorials. Saved me hundreds over the years. Start with small trims until you build confidence.

15. Embrace hand-me-downs

Especially for baby and toddler gear because kids grow fast. Accepting gently used items from friends or local groups can save you a fortune. And most items are barely worn.

16. DIY your household cleaners

Vinegar, baking soda, and essential oils go a long way. You’ll avoid harsh chemicals and save money at the same time. One batch can last for months.

17. Line dry your clothes

Cut down on electricity use and preserve your clothes longer. It adds a vintage vibe to your routine and saves energy. Bonus: it’s gentler on delicate fabrics.

18. Use your local library like a boss

Books, movies, museum passes, free events – it’s a hidden goldmine. Libraries are more than shelves, they’re community hubs. Take advantage of everything they offer.

19. Cancel cable (seriously)

Streaming + a digital antenna = huge monthly savings. You can still access news, sports, and shows without the bloated bill. Consider splitting subscriptions with friends.

20. Drink more water (and less soda)

Better for your health and budget. Even switching to tap water with a filter can save hundreds yearly. Bonus: no sugar crashes or caffeine jitters.

21. Automate savings (even $20/week)

You won’t miss it if it’s automatic and it adds up fast. Set it and forget it with a recurring transfer to a high-yield savings account. You’ll build momentum and motivation with every deposit.

22. Use a budget calendar

Plot out fixed bills, paydays, and expenses so nothing surprises you. It’s a visual way to stay on track and anticipate needs. Budgeting doesn’t have to be boring, it can be your superpower.

23. Reuse and repurpose containers

Jars become Tupperware. Old t-shirts become cleaning rags. You’ll buy less and waste less, which is a double win for your wallet and the planet.

24. Negotiate your bills yearly

For internet, insurance and phone bills, you should call and ask for a lower rate or promo deal. You’ll be surprised how often companies say yes to avoid losing a customer. Set a calendar reminder each year.

25. Skip fancy coffee & make it at home

Get a milk frother. Sprinkle cinnamon. Feel fancy for $0.50. That $6 coffee habit daily adds up to over $2,000 per year.

26. Host potlucks instead of going out

You still get social time without a $70 dinner tab. Everyone brings a dish, and no one feels pressure to overspend. It’s fun, cozy, and way cheaper.

27. Freeze leftover herbs or broth

Preserve flavor and stop throwing away food. Ice cube trays work great for portioning. It’s like future-you left a care package in the freezer.

28. Set up a babysitting swap

Trade childcare with another parent to avoid paid sitters. Everyone gets free time, and kids get playdates. It’s a win-win for budget and sanity.

29. Shop secondhand first

Thrift stores, Facebook Marketplace, OfferUp – there are hidden gems everywhere. You’ll find clothes, furniture, toys, and even tools for a fraction of retail. Make it your first stop, not your last resort.

30. Learn basic sewing

Fix holes, hem pants, extend clothing life. You don’t need to be a pro, just enough to keep things wearable. A $5 sewing kit can save hundreds over time.

31. Use WIC, SNAP, or local food pantries if needed

No shame – these programs exist to support families. They’re a bridge, not a failure. Reach out and get what you need to stay afloat.

32. Apply for utility assistance

Many areas offer reduced-rate programs or seasonal help. Just call your provider and ask. Often, it’s a short form and quick approval.

33. Set up free family fun nights

Game night, library visits, movie marathons with popcorn. Make memories without spending money. It’s about connection, not cost.

34. Declutter and sell unused items

A garage clean-out can turn into emergency cash fast. List on Facebook Marketplace, Craigslist, or host a yard sale. It feels good to lighten the load and fatten your wallet.

35. Batch errands to save gas

Less driving = less fuel + less temptation to spend. Group trips by location to save time too. Keep a running list on your phone.

36. Skip single-use items

Use cloth instead of paper towels, reusable instead of disposable. It’s an upfront switch that pays off over time. Plus, it’s better for the environment.

37. Choose experiences over things

A day at the park can be more memorable than new toys. Focus on connection, not consumption. Kids will remember how you made them feel, not what you bought.

38. Teach kids about money early

Set up a savings jar. Let them earn, save, and spend mindfully. Money habits form young, give them tools early.

39. Create a sinking fund for annual expenses

Christmas, back-to-school, birthdays, you should set aside small amounts year-round. No more scrambling or going into debt when those seasons hit. Peace of mind is priceless.

40. Cut back on gift-giving expectations

Homemade or heartfelt often beats expensive. Set clear boundaries with friends and family. Most people are relieved, not offended.

41. Have a “use it up” month

Don’t buy anything new unless you absolutely need it. Use what’s in the freezer, finish half-used products, and stretch what you already own. It’s eye-opening and satisfying.

42. Rotate your streaming services

Only pay for one or two each month and rotate as needed. Binge what you want, then cancel and switch. Avoid paying for six at once.

43. DIY your skincare or beauty routine

Sugar scrubs, coconut oil, and clay masks are budget-friendly. You get spa vibes at home without the $80 facial. Bonus: you control the ingredients.

44. Borrow tools or gear instead of buying

Check Buy Nothing groups or ask neighbors. Most tools are used once or twice a year so why spend full price? Share the wealth and return the favor.

45. Plan your errands with coupons in hand

Never go in-store without checking apps like Ibotta or Fetch. Combine sales with digital coupons for max savings. It becomes a game and you win every time.

46. Walk or bike when possible

Free transportation and fitness. You’ll save on gas, car wear, and gym memberships. Bonus: sunshine improves your mood.

47. Use a price comparison app

Flipp, Price.com, or just Google Shopping saves you from overpaying. A few taps can save a few bucks, then multiply that across a year. Be the shopper who always gets the deal.

48. Pause before every purchase

Wait 24 hours before buying anything non-essential. Most times, you won’t even want it later. It’s a built-in filter for impulse control.

49. Create a visual savings goal

Whether it’s a thermometer chart or savings jar, it keeps you focused. Seeing progress builds momentum. It’s more satisfying than any shopping spree.

50. Celebrate progress, not perfection

Frugal living is a mindset shift, not a punishment. You’re building freedom. Small wins stacked over time = big change.

Final Thoughts: Frugal Living is About Choice, Not Sacrifice

Frugality gets a bad rap as restrictive or boring but I’ve found the opposite to be true.

When you stop chasing shiny objects and start creating systems that actually work for your life, you feel more peace. More power. More clarity.

Whether you’re a frugal mom feeding a family of five or someone just learning how to live frugally and save money daily, remember: every small choice matters.

You don’t have to do all 50 at once. Pick five. Try them for a month. Add more later.

And if this helped you? Bookmark it, share it, or subscribe for more practical ways to cut expenses and save. I’ve got a lot more where this came from.

👉 Follow me on Pinterest for more tips on wealth, money and business!

Looking to Improve Your Money Skills? Learn More

- The Best Beginner Budgeting Apps to Try This Year

- Roth IRA Stock Investing Tips to Build Wealth

- How to Start the Half Payment Budget Method

- 12 Financial Goals to Build Wealth in Your 20s

- 12 Financial Goals to Build Wealth in Your 30s

- How to Lower Your Life Insurance Premiums

My Favorite Tools

To help you reach your financial goals, below are resources you can use to get started. They are free to sign up and will support your money goals.

Leave a Reply