We’re going to talk about a topic that might not be the most interesting, but is really important – and that’s how to lower your life insurance premiums.

As someone who’s navigated the world of insurance and wants to make sure you’re getting the best bang for your buck, I’m here to help break it down for you. No jargon – just practical, actionable tips you can use today.

I get it, I know the feeling. If you needed some persuading to get life insurance, you’re probably now looking for ways to save on the premiums.

If you truly want financial security and to protect your family, then an affordable life insurance policy is a must-have. Now you might be skeptical, I get it – those premiums can sometimes feel like a significant chunk of your monthly spending.

However, on the bright side, there are ways to potentially make those costs more manageable without sacrificing the coverage you need.

Consider this your friendly guide to becoming a smart life insurance shopper. We’ll discuss everything from your health and habits to the different policy options out there.

Ready to save some money? Let’s save you some money.

Table of Contents

Prioritize Your Health: The Biggest Factor

This might sound obvious, but your health is arguably the single biggest factor influencing your life insurance premiums. Insurance companies assess your risk based on your health profile. The healthier you are, the lower your “perceived risk”, and therefore, the lower your premiums will be.

Here’s how you can leverage your health to your advantage:

- Maintain a Healthy Weight: Losing even a few pounds can help lower your premium.

- Exercise Regularly: Shows your committed to a healthy lifestyle.

- Eat a Balanced Diet: Supports good health and prevents issues. Limit unhealthy foods.

- Quit Smoking/Tobacco: This is a major red flag for insurance companies and one of the main premium increase factors. Quitting can help lower costs.

- Manage Existing Conditions: Stay on top of any current health conditions which can potentially lead to lower premiums.

- Get Regular Checkups: Catches potential issues early.

What to consider:

Keep in mind, health is key for life insurance. It’s a big factor when you first apply and also if you ever want to change your policy later on.

For example, if you got a 10-year plan and want to extend it, they’ll check your health again because things change over time. Your current health will determine your coverage and cost.

Age Factor

The younger you are when you apply for life insurance, then generally the healthier you‘re perceived to be, and as a result, the lower your premiums will likely be.

Think of it like this – insurance companies are assessing risk. A younger person has, statistically, a longer life expectancy and is less likely to have developed age-related health issues or chronic conditions. This lower risk translates directly into lower premiums.

For example, let’s consider two people who are both looking for a $500,000 term life insurance policy. One applies at age 30, and the other waits until age 50.

The person who applied at 30 will most likely pay much lower monthly or annual premiums. Why? This is because younger people are generally seen as less risky by insurers.

So if possible, don’t delay getting life insurance. Even if you think you don’t need it right now, the younger you are, the better your chances of securing more affordable coverage. As we age and potential health factors develop, the cost of life insurance goes up.

Most people make the mistake of waiting until they have a health scare to take action, and by then, it’s too late because you’re real risky to a life insurance company.

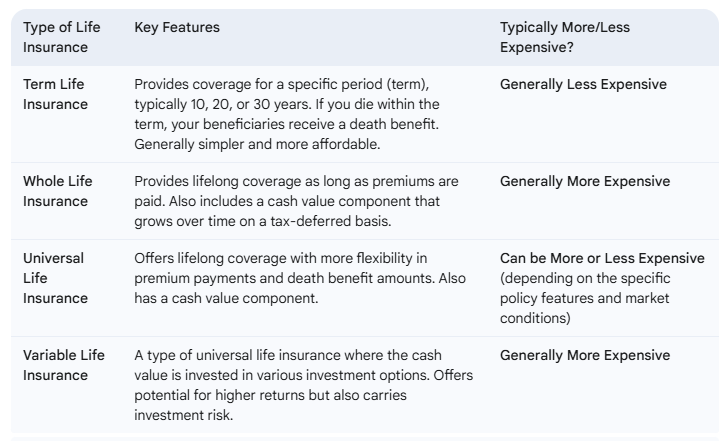

Understand the Different Types of Life Insurance

Not all life insurance policies are created equal, and the type of policy you choose can make a huge impact on your premiums. Here’s a short rundown of the most common types:

Why does this matter for lowering premiums?

- Term Life Insurance is most often the most affordable option, especially for younger and healthier individuals. If you only need coverage for a specific period (example, until your kids are financially independent or your mortgage is paid off), term life might be the smarter choice to save cost.

- Permanent Life Insurance (Whole, Universal, Variable) offers lifelong coverage but comes with higher premiums due to the lifelong nature of the policy and the cash value component. These choices might not be the best fit if your main goal is to lower your premium costs.

Learn how life insurance works and choose the right plan for you.

Tip: Revisit your current and future financial needs. If you only need coverage for a specific timeframe, consider term life insurance.

Shop Around and Compare Quotes

Just like you wouldn’t buy the first car you see without comparing prices, you seriously shouldn’t settle for the first life insurance quote you receive.

Every insurance company has different underwriting criteria and pricing structures, so what one insurance company offers might be way different in price compared to another.

Here’s how to shop around:

- Use Online Quote Comparison Tools: Some of these websites let you get quotes quickly from insurers.

- Work with an Independent Insurance Broker: An independent broker has connections with multiple insurance companies and can help you compare quotes to find the best deal for you.

- Get Insurance Quotes from Companies Directly: Reach out to a few insurance companies with a great reputation to get personalized quotes. (I personally prefer this option rather than using online tools).

- Be Consistent with Your Information: When you’re requesting quotes, make sure you provide the same accurate information to each insurer. This will help you compare prices fairly.

Insurance Tip: When you’re searching for the right life insurance, don’t overlook the company’s reputation. You should definitely do a little digging. Ask your circle – friends, family, and colleagues about their experiences with different providers.

Another area to look at is checking with your existing auto insurance company, as many of them offer life insurance options as well.

Additionally, organizations like AAA can be a good starting point for exploring your choices.

Take the time to research the insurer to give you peace of mind knowing you’re in good hands.

Choose the Right Coverage Amount

You definitely need enough life insurance, but you don’t want to go overboard. More coverage usually means you’ll pay more each month.

Consider these factors when determining the right amount of coverage:

- Your Debts: Include mortgages, car loans, credit card debt, and any other outstanding debts.

- Income Replacement: Calculate how many years of income your family would need to maintain their current lifestyle.

- Final Expenses: Factor in funeral costs, medical bills, and other end-of-life expenses.

- Future Needs: Consider college education for your kids or other future financial goals.

General Rule of Thumb: A good starting point is to have life insurance coverage that is around 10 to 15 times your annual income.

This way you can make sure your loved ones have enough to cover expenses, debts, and future needs.

But keep in mind, everyone’s situation is unique. So if you have fewer financial responsibilities or extra assets, you might not need as much.

Consider a Shorter Term (If Applicable)

If you currently have a longer-term policy (let’s say a 30-year term) and your financial situation has changed, you might be able to lower your premiums by switching to a shorter-term policy like a 10 or 20-year term.

However, consider the following:

- Your Age: Premiums increase as you get older. Switching to a shorter term later in life might not make too big of a difference and could even be more expensive in the long run.

- Your Future Needs: Make sure that a shorter term still provides enough coverage for your remaining financial obligations.

Sometimes you may need coverage for a certain time until you get your finances in order, and once so, you might choose to shorten the duration of your policy.

Pay Your Premiums Annually (If Possible)

Most insurance companies offer a discount if you pay your premiums annually instead of monthly. This is because it reduces their administrative costs.

If you have the financial means to do so, consider paying your premiums annually to save some money.

To be sure, always double check with your insurer before you pay your premiums for the entire year.

Review Your Policy Regularly

Your life insurance needs and your health can change over time. It’s good to review your policy every few years or whenever you experience a major life event, like:

- Getting married or divorced

- Having children

- Buying a new home

- Paying off a large amount of debt

- Experiencing a change in your health

During your review, you can reassess your coverage needs and decide if there are any opportunities to lower your premiums based on your current circumstances. When you speak with your provider, you should also ask them about any policy riders in your policy that might be unnecessary. In cases of cutting costs, details matter and you might not need them all.

A policy rider is an add-on to a life insurance policy that provides additional benefits or coverage beyond the standard death benefit.

So for example, the Disability Income Rider helps to provide income if the insured person becomes disabled and can’t work.

Tip: Schedule a reminder to review your life insurance policy every 2-3 years or whenever a major life event occurs.

Be Honest in Your Application

When applying for life insurance, it’s super important to be completely honest and accurate in your application. If you withhold information or provide false statements, it can lead to your policy being voided later on.

They’re going to want to know the truth about your health, and sometimes they’ll even ask for a blood test.

With my insurer, I had to take a blood test and submit the results for my policy. Then I had to do it again seven years later when I made changes to my policy.

Consider Group Life Insurance (If Available)

If your employer offers group life insurance, it can sometimes be a more affordable option, but the coverage amount is not always the greatest.

Pros: Often lower premiums, easy to enroll.

Cons: Coverage might not be enough, coverage usually ends if you leave your job. But check with your employer to be sure!

Insurance Tip: Check if your employer offers group life insurance and compare the coverage and cost to individual policies.

Improve Your Lifestyle Over Time

Even if you have a policy right now, making positive lifestyle changes can potentially lead to lower premiums in the future.

For example, if you quit smoking and maintain a healthy weight for a certain period, you might be eligible for a lower premium rate.

Insurance Tip: You might be able to revisit your insurance policy later on to see if you qualify for a lower rate.

Key Takeaways for Lowering Your Life Insurance Premiums

- Prioritize your health: It’s the most important factor.

- Understand the different types of policies: Choose the one that best fits your needs and budget.

- Shop around and compare insurance quotes: Don’t settle for the first offer.

- Choose the right coverage amount: Don’t over-insure.

- Consider a shorter term (if applicable): Review your current needs.

- Pay annually if possible: Some insurers offers a discount.

- Review your policy regularly: Make sure it still meets your needs.

- Be honest and accurate in your application: Avoid future complications.

- Consider group life insurance: If it’s an option through your employer and gives you the coverage you need.

- Improve your lifestyle over time: It can potentially lead to future savings.

Lowering your life insurance premiums is completely possible and should always be considered because why not? With a few smart moves, you can save money while still protecting your family’s financial future. It’s all about making informed choices that give you peace of mind.

Take a few minutes today to review your policy and see where you can make improvements. Your future self—and your loved ones—will be happy you did!

👉 Follow me on Pinterest for more tips on wealth, money and business!

More Reading About Life Insurance Premiums

My Favorite Tools

To help you reach your financial goals, below are resources you can use to get started. Most are free to sign up and will support your money goals.

Leave a Reply