Money makes the world go round, but let’s be honest—financial jargon can be confusing. Whether you’re budgeting, investing, or just trying to make sense of your paycheck, understanding key financial terms is important as you’re on your journey to building wealth.

The good news? You don’t need a degree in finance to grasp the basics. By learning these 40 must-know financial terms, you’ll gain the confidence to manage your money wisely, make informed decisions, and even start growing your wealth.

Imagine being able to confidently discuss your money plans with a financial advisor or banker, or understand the implications of a new loan offer. Picture yourself creating a budget that actually works, or finally understanding how your investments are performing.

These terms are the building blocks, the foundation upon which you can build a secure and prosperous financial future for yourself and your family. We’ll break down each concept in a way that’s easy to digest, using examples and avoiding confusing jargon.

So, whether you’re just starting your financial journey or looking to brush up on your knowledge, you’re in the right place.

Let’s get started!

Table of Contents

Basic Financial Terms

I really want to focus on the basics. Back when I was a college student (many, many years ago) and started learning about personal finance, money management, and trying to grow a business, I quickly realized that understanding the language was key.

I made the commitment that if I really wanted to take my wealth building serious, I needed to understand the core terms. Which in turn helped me feel much more confident navigating the world of finance.

These building blocks empower you to make informed decisions, whether you’re planning for retirement, managing debt, or just trying to understand your paycheck (very important by the way!). If you’re lost when people start talking about finances, don’t worry, it’s totally normal. Once you get the hang of these terms, you’ll be amazed at how much more confident you feel.

- Income – The money you earn, whether from a job, business, or investments.

- Expense – The money you spend on necessities (like rent) and non-essentials (like streaming services).

- Budget – A plan for how you’ll allocate your income toward expenses, savings, and investments.

- Cash Flow – The movement of money in and out of your finances—positive cash flow means more money is coming in than going out.

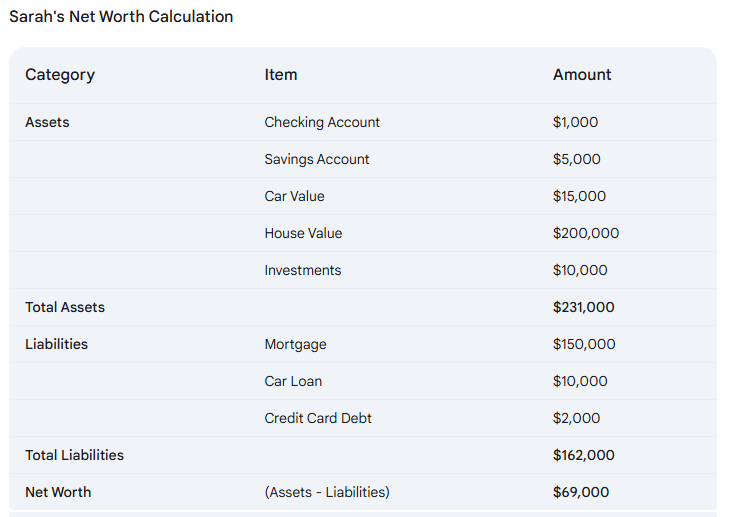

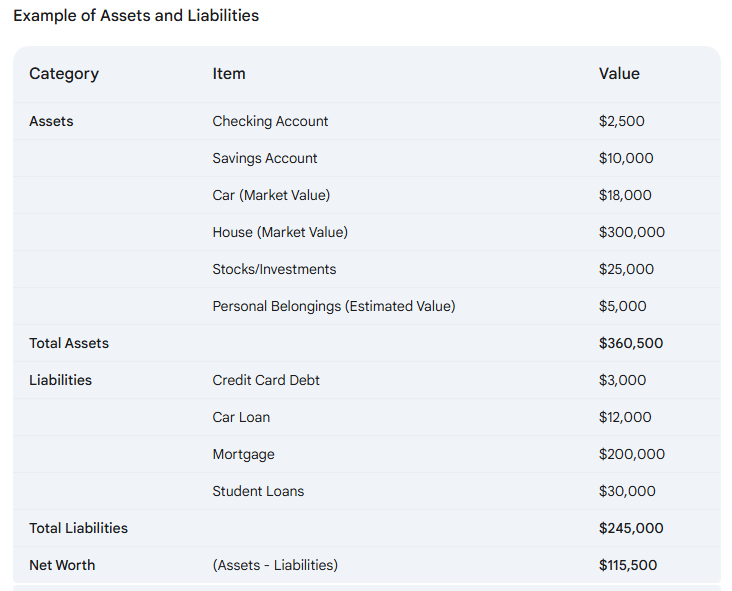

- Net Worth – Your total assets minus your total liabilities (what you own vs. what you owe).

Banking & Saving Terms

Next, let’s talk banking and saving. Now, I know what you might be thinking: ‘Ugh, finances.’ But trust me, understanding these terms is way easier than it sounds, and it’ll make your life so much simpler.

Whether you’re opening a new account, trying to build an emergency fund, or just want to make the most of your money, knowing the basics can help you avoid fees, earn more interest, and stay in control of your finances.

So, let’s break it all down in a way that actually makes sense!

- Checking Account – A bank account for daily transactions like deposits, withdrawals, and bill payments.

- Savings Account – A bank account that earns interest on the money you save over time.

- Interest – The cost of borrowing money or the return you earn on savings and investments.

- Overdraft – When you spend more than what’s available in your bank account, leading to fees or penalties.

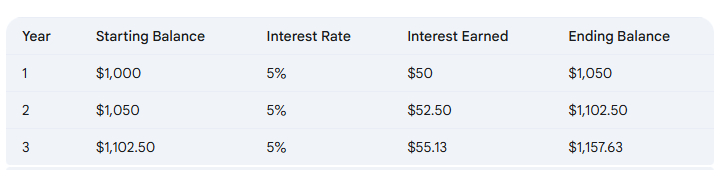

- Compound Interest – Interest calculated on both the initial amount and any accumulated interest.

A $1,000 initial investment over three years (no additional deposits since the start).

Credit & Debt Terms

Whether you’re applying for a credit card, paying off student loans, taking out a loan, or just trying to improve your credit score, knowing these terms will help you make smarter money decisions. Chances are, you’ll deal with loans at some point in your life.

To really understand what’s happening with your money, it’s important to look beyond the initial loan amount and familiarize yourself with the core terminology.

In this guide, we’ll break down common credit and debt terms in a simple, no-nonsense way, so you can feel confident managing your finances.

- Credit Score – A number that represents your creditworthiness, affecting your ability to get loans or credit cards.

- Credit Report – A detailed record of your credit history, including loans, payments, and inquiries.

- APR (Annual Percentage Rate) – The total cost of borrowing money, including interest and fees.

- Loan Principal – The original amount borrowed before interest is added.

- Debt-to-Income Ratio (DTI) – A measure of how much of your income goes toward debt payments.

Investing & Financial Terms

Next, let’s demystify investing! If you’ve ever felt intimidated by the stock market, or anything else that falls under the ‘investing’ umbrella, you’re not alone. And honestly, that intimidation often leads to inaction, until something forces us to pay attention.

It’s interesting because most people I talk to don’t really pay attention to investing until something goes wrong – maybe their 401(k) or Roth IRA looks off, there’s panic in the stock market and everyone is selling, or they suddenly need their money to grow faster than a basic savings account (where its value declines daily).

Even if you’re not ready now, this is still good to know for the future. I’m a firm believer that you don’t need to be an expert, but you should know what’s going on with your money and how to make the most of it.

- Stock – A share of ownership in a company.

- Mutual Fund – A pooled investment fund managed by professionals to invest in stocks, bonds, or other assets.

- ETF (Exchange-Traded Fund) – Similar to a mutual fund but traded on stock exchanges like individual stocks.

- Bond – A loan you give to a company or government in exchange for interest payments.

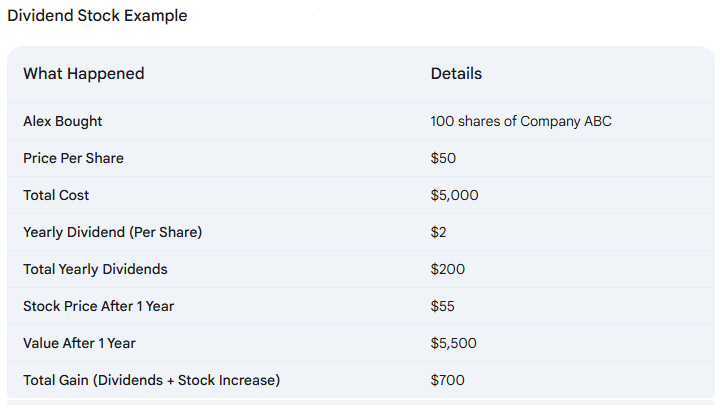

- Dividend – A portion of a company’s earnings paid to shareholders.

Retirement & Wealth-Building Terms

Let’s face it, the idea of retirement can feel like a million miles away, especially if you’re just starting out. But whether you’re planning for your golden years or simply want to build long-term wealth, understanding the right terms is absolutely essential.

We’re going to break down the key terms related to retirement planning and wealth building, so you can feel empowered to make smart decisions for your financial future.

- 401(k) – An employer-sponsored retirement plan that allows tax-advantaged contributions.

- IRA (Individual Retirement Account) – A tax-advantaged retirement account you set up independently.

- Roth IRA – A retirement account where contributions are made after-tax, but withdrawals are tax-free. Learn more here on how to grow your Roth IRA investments.

- Pension – A retirement plan that provides monthly income after you retire, often funded by an employer.

- Annuity – A financial product that provides steady income, typically for retirement.

Tax Terms

Now, let’s tackle taxes. I know, just the word can make anyone’s eyes glaze over. But here’s the thing: understanding tax terms isn’t just for accountants. It’s for everyone who wants to keep more of their hard-earned money.

We’re going to break down the key concepts, so you can navigate tax season with confidence. Whether you’re dealing with deductions, credits, or just trying to understand your W-2, we’ll make it easier to understand.

- Gross Income – Your total earnings before taxes and deductions.

- Net Income – Your take-home pay after taxes and deductions.

- Tax Deduction – An expense that reduces your taxable income, such as mortgage interest or student loan interest.

- Tax Credit – A dollar-for-dollar reduction in your tax bill (e.g., child tax credit).

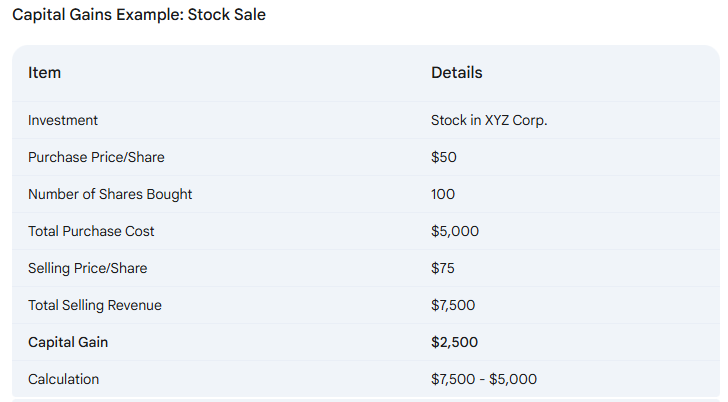

- Capital Gains – The profit from selling an investment, such as stocks or real estate.

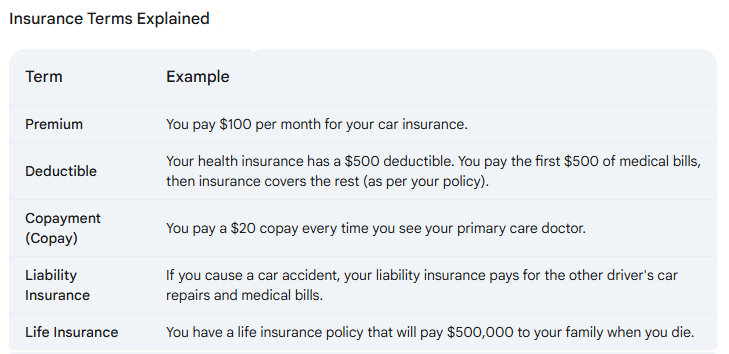

Insurance Terms

Insurance. It’s one of those things we know we need, but understanding the lingo can feel like trying to decipher a secret code.

Whether you’re dealing with health insurance, car insurance, or home insurance, knowing the key terms is important for making smart decisions and protecting yourself financially.

We’re going to break down the most important insurance terms into plain, easy-to-understand language. No jargon, no confusing clauses – just a straightforward term list to help you navigate the world of insurance with confidence.

- Premium – The cost you pay regularly (monthly, yearly) for your insurance policy.

- Deductible – The amount you must pay out-of-pocket before insurance kicks in.

- Copayment (Copay) – A fixed amount you pay for a medical service, separate from insurance coverage.

- Liability Insurance – Coverage that protects you if you’re held responsible for damages or injuries.

- Life Insurance – A policy that pays beneficiaries a sum of money when you pass away.

Miscellaneous Financial Terms

Alright, to wrap things up, we’re going to cover a few more financial terms that’ll help you understand how the economy works.

These are the concepts that often pop up in financial discussions, and understanding them can give you a well-rounded perspective on how money works in the real world.

We’ll cover everything from the silent thief of purchasing power, inflation, to the broader economic shifts that can impact your financial decisions, like recessions. Plus, we’ll clarify the difference between what you own and what you owe, and why spreading your investments is key.

Let’s get these last pieces of the puzzle in place.

- Inflation – The rise in prices over time, reducing purchasing power.

- Recession – A period of economic decline, typically marked by job losses and lower consumer spending.

- Diversification – Spreading investments across different assets to reduce risk.

- Asset – Anything of value you own, such as cash, real estate, or stocks.

- Liability – Any debt or financial obligation you owe.

Taking Control of Your Money

So we’ve covered a lot of ground, haven’t we? We’ve gone through everything from basic budgeting to the ins and outs of investing, and even tackled the sometimes-boring world of taxes and insurance. And look at you now! You’re armed with a whole new vocabulary, ready to tackle your financial journey with confidence.

Honestly, getting to grips with these terms isn’t just about sounding smart at a dinner party (though, that’s a nice bonus!). It’s about taking control.

It’s about saying, “Hey, I understand what’s happening with my money, and I’m going to make it work for me.” That’s the real power of financial literacy. It’s not about becoming a Wall Street guru overnight; it’s about building a solid foundation, brick by brick.

At first you might be trying to figure out the grammar, and maybe even feeling a little lost. But as you practice, as you start using those words in everyday conversations, it becomes second nature. That’s exactly how it is with finance.

And let’s be real, money can be emotional. It can be a source of stress, anxiety, even fear. But the more you understand, the less scary it becomes. When you know what a “deductible” is, or how “compound interest” works, you’re not just dealing with abstract concepts anymore. You’re making informed choices, and that’s incredibly empowering.

Final Thoughts

Don’t get discouraged if you don’t remember everything right away. This isn’t a race. It’s a journey. You’re building a skillset that will serve you for years to come. And the best part? You’re not alone.

There are tons of resources out there, from books and blogs to podcasts and online communities, all designed to help you along the way.

Remember that understanding these financial terms is the first step toward financial literacy and independence. Whether you’re creating a budget, opening an investment account, or planning for retirement, this knowledge will empower you to make informed decisions.

And, more importantly, you’ll be able to have meaningful conversations with financial professionals, asking the right questions and getting the right answers.

So, go out there and put your newfound knowledge to good use. Start small, maybe by reviewing your budget or setting up a savings goal.

Every little bit counts. And as you continue to learn and grow, you’ll find that managing your money isn’t just something you have to do—it’s something you can do, and you can do it well. You’ve got this!

Got any terms you’d like me to break down further? Drop them in the comments!

👉 Follow me on Pinterest for more tips on wealth, money and business!

More Reading About Personal Finance

- How to Lower your Life Insurance Premiums

- Roth IRA Stock Investing Tips to Build Wealth

- Financial Goals to Build Wealth in Your 20s

My Favorite Tools

To help you reach your financial goals, below are resources you can use to get started. Most are free to sign up and will support your money goals.

Leave a Reply