As an entrepreneur, freelancer, or side hustler, you’ll find that running a business comes with costs—it’s just part of the game. But here’s the good news, many of those expenses qualify as a business expense write–off and can actually work in your favor when it’s time to file taxes.

Understanding tax deductions can save you a significant amount of money.

By knowing which expenses you can write off, you can lower your taxable income and keep more of your hard-earned cash.

Whether you file taxes annually or quarterly, you’re probably wondering, “What expenses can I actually write off this year?”

Let’s be real—navigating tax deductions can feel like piecing together a puzzle with missing parts.

However, as a small business owner, the IRS allows you to deduct many of your business expenses, helping you lower your taxable income and keep more money in your pocket.

After all, you’ve probably heard the saying, “It takes money to make money,” and to build, operate, and grow a business, there are costs.

To make tax season a little less stressful, I’ve put together a list of 25 tax deductions that entrepreneurs, creators, freelancers, and small business owners can take advantage of.

Let’s break it down and see where you can save!

Disclosure: Our website is reader-supported. If you purchase any service through our partner links, we may earn a commission at no extra cost to you.

Note: I am not a financial advisor and the content here is not to be considered financial advice. Always consult with your own tax professional to get advice that relates to your personal situation, and the tax laws in your country.

Table of Contents

1. Home Office Deduction

If you’re working from home – you could potentially deduct a portion of your home expenses! This is done by calculating the square footage of your workspace compared to the rest of your home.

This includes your rent or mortgage, utilities, even electricity and maintenance.

But here’s the catch: your home office needs to be used solely for business, and there are rules about the size of your workspace compared to the rest your home.

For example, let’s say your home office is 20% of your total home space. In that case, you can write off 20% of what you paid for utilities throughout the year.

Your accountant can help you figure out the details.

2. Home Office Supplies and Equipment

These home office essentials qualify as business expense write-offs, helping you manage your online business and save on taxes.

Some deductible purchases include:

- Basic office supplies – Pens, pencils, notebooks, sticky notes, paper, paper clips, staplers, and printer ink.

- Printing and mailing expenses – Printer paper, envelopes, stamps, and shipping supplies needed for business or product delivery.

- Technology and electronics – Computers, laptops, external monitors, keyboards, mice, printers, and scanners, as well as accessories like cables, USB drives, and headsets.

- Office furniture – Desks, ergonomic chairs, filing cabinets, shelves, and other storage needs that help create a functional workspace.

- Internet and communication tools – Routers, modems, and even a portion of your internet bill, if used primarily for business purposes.

3. Business Travel and Meals

For example, if you travel to meet with clients or attend industry conferences, those travel costs can be considered as business expense write offs.

Business-related travel expenses include:

- Airfare, hotels, and car rentals.

- Taxi, rideshare, or public transportation costs.

- 50% of meals during business travel or client meetings (keep detailed records).

4. Marketing and Advertising

Marketing and advertising is needed to bring more attention to your business. The good news is that this is a tax write-off.

Deductible expenses include:

- Social media ads (Facebook, Instagram, TikTok, Pinterest ads)

- Other forms of ads (Google, Bing, Print ads, etc)

- Website hosting and design costs.

- Influencer partnerships and sponsorships.

- Promotional materials like business cards and branded merchandise.

- Any other tools used to promote your business.

5. Professional Services and Education (Courses and Coaching)

Growing your business means staying in the know. That’s why you often invest in things like courses, coaches, or consultants to get those strategic insights. Good news: these kinds of investments can often be written off on your taxes.

Examples include:

- Hiring consultants, accountants, or legal professionals is deductible.

- Education-related deductions include:

- Online courses, workshops, and business seminars.

- Books and industry-specific publications.

6. Health Insurance Premiums

Self-employed individuals can deduct health insurance premiums, including:

- Medical, dental, and vision coverage.

- Coverage for yourself, your spouse, and dependents.

7. Internet and Phone Bills

As a creator, you probably use your cell phone more for business than anything else.

Be sure to track the percentage of business use to claim the right amount.

Your monthly internet and phone bills, as well as internet-related hardware purchases (such as routers and modems), are business expense write-offs.

8. Vehicle Expenses

If you use your car for business, you can deduct:

- Mileage, gas, maintenance, and insurance costs.

- Parking fees and tolls.

- Lease payments for a business vehicle.

9. Salaries and Contractor Payments

Paying people who work for you – whether they’re employees, freelancers, or contractors – is a tax write-off. This helps you pay less in taxes. To keep things simple, make sure you keep good records of every payment and all the paperwork.

Keep all your contracts, invoices, and payment receipts organized. This makes tax time way easier and protects you. Being organized with your payments means you can take advantage of all your tax deductions!

I personally use QuickBooks to keep my finances organized and automated. It connects directly to my bank accounts, making it easy to track expenses and separate personal and business spending. Plus, I can create and send invoices, track my mileage, and manage everything in one place.

According to QuickBooks, their users see impressive benefits, including:

– $30,645 in tax deductions per year on average

– An average of $16,317 in tax savings per year

– A 38% average reduction in their annual tax bill

I’ve collaborated with them to offer my readers a great opportunity to save 30% off for 6 months!

10. Retirement Contributions

These contributions reduce your taxable income while helping you save for the future.

- Contributions to retirement plans such as:

- SEP IRA

- Solo 401(k)

- Other small business retirement plans

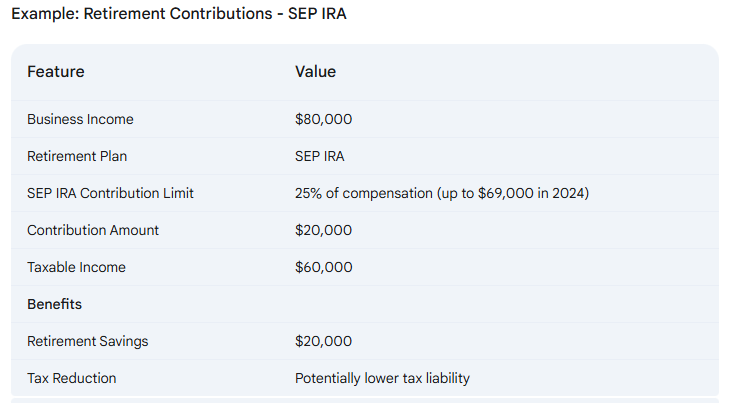

Imagine you own a small life coaching business. You want to save for retirement while also reducing your current year’s tax burden so you decide to open a SEP IRA.

Notes to consider:

- You contribute 25% of your income to your SEP IRA: $80,000 x 0.25 = $20,000

- Impact on Taxable Income: Your taxable income is now reduced by $20,000: $80,000 – $20,000 = $60,000.

- Benefits:

- You saved $20,000 towards your retirement.

- Your current year’s taxable income is $20,000 lower, potentially reducing your tax liability.

11. Website Expenses

In today’s digital age, your online presence is often your storefront. That means the costs associated with building and maintaining your business, like domain registrations and website hosting, are legitimate tax write-off business expenses.

These may include:

- Domain purchases and web hosting.

- Website design and maintenance fees.

- Plugins, themes, and site security tools.

12. Software & Subscriptions

As an entrepreneur, your software subscriptions are almost essential so you can stay operating your business.

Common deductible software includes:

- Digital tools like Canva (paid plan), Adobe Creative Suite, Microsoft Office, etc.

- CRM tools like Kajabi, HubSpot, Salesforce, etc.

- Email marketing software like Kit (formerly ConvertKit)

13. Cloud Storage Services

One area many entrepreneurs overlook is their digital expenses! Cloud storage services are essential for storing important files, collaborating with team members, and accessing your data from anywhere. The good news? The cost of these services can often be deducted from your business income.

- Payments for cloud-based services like:

- Google Suite

- Dropbox

- OneDrive

14. Co-working Space Fees

If you rent a co-working space instead of working from home, your membership fees and rent may be business expense write-off.

15. Business Insurance

Have a conversation with your accountant to learn more about claiming additional insurances, specifically home and health, as tax write-offs.

Other deductible business insurances include:

- Liability insurance.

- Errors and omissions (E&O) insurance.

- Cybersecurity insurance.

16. Licenses & Permits

- Business Registration: The fee you paid to your state to officially register your business (e.g., LLC, sole proprietorship).

- Professional Licenses: Costs that come with with getting or renewing licenses required for your profession (e.g., real estate license, contractor’s license, cosmetology license).

- Industry-Specific Permits: Fees for permits needed to operate legally in your industry (e.g., food handler’s permit, building permit, waste disposal permit).

- Occupational Licenses: Licenses required by your city or county to conduct business (e.g., a general business license).

17. Shipping & Postage

If you mail products, documents, or business correspondence, costs for postage and shipping are deductible.

18. Merchant Processing Fees

If you pay your team or virtual assistants through a payment processor, the fees from services like Stripe, PayPal, or Square are considered business expenses and are tax-deductible.

19. Education, Networking & Membership Expenses

Learning is huge for growing your business. Here’s a bonus – a lot of that learning can actually be a tax write-off.

Things like:

- Books

- Online courses

- Seminars and conferences

- Membership fees for business-related groups, industry associations, or networking organizations can be written off

20. Gifts & Client Appreciation

Showing appreciation to your clients can go a long way in building strong relationships. Fortunately, the IRS recognizes the importance of client relationships and allows you to deduct certain gifts as business expenses.

While there are some limitations to keep in mind, thoughtful gestures of gratitude can not only strengthen your client bonds but also reduce your tax bill.

More Examples:

- Gift baskets: Sending a client a gift basket of local products or treats.

- Event tickets: Providing clients with tickets to a sporting event, concert, or theater performance.

- Company swag: Giving clients branded merchandise like hats, t-shirts, or mugs.

- Gift cards: Offering gift cards to popular restaurants or stores.

- Charitable donations in a client’s name: Donating to a charity of your client’s choice and notifying them of the donation.

21. Business Bank Fees

Managing your business finances inevitably comes with certain banking expenses. But the good news is that many of these costs can be deducted on your tax return, helping you reduce your overall tax liability.

More Examples:

- Account maintenance fees: Monthly fees charged for maintaining a business bank account.

- Overdraft fees: (However, it’s best to avoid these!)

- Stop payment fees: Charges for stopping a payment on a check.

- Foreign transaction fees: Fees for transactions in a foreign currency.

- ATM fees: (If used for business purposes).

22. Digital Products & Downloads

Purchases of stock photos, graphic templates, fonts, or other digital assets used for your business qualify as a business expense write-offs.

23. Training & Coaching

What you paid for business coaching, consulting, mentorship programs, or specialized training courses can be deducted.

24. Office & Ergonomic Equipment

If you invest in improving your workspace, these costs may be deductible:

Examples:

- Ergonomic chairs and standing desks.

- Wall art or lighting that enhances productivity.

- Printer, printer ink, printer paper

25. Charitable Contributions

If your business makes donations to eligible charities, you may be able to deduct these contributions.

Final Thoughts

Remember, as a creator, entrepreneur, or business owner, it’s important to stay on top of these potential deductions.

By carefully tracking and claiming legitimate expenses, you can significantly reduce your tax burden and free up more money to reinvest in your business.

If you’re looking to get ahead and not fall behind – I’ve collaborated with Quickbooks to offer my readers a great opportunity to save 30% off for 6 months!

It’s super simple, automatically pulls my expenses from my bank accounts and I just have to make sure they’re assigned to the appropriate expense. That’s it! Saves me a ton of time and headache.

With a little knowledge and planning, you can drastically increase your tax savings and keep more of your hard-earned cash to build your business! As always, consult with a tax professional for personalized advice.

👉 Follow me on Pinterest for more tips on wealth, money and business!

More Reading About Money & Finance

- 40 Must-Know Financial Terms for Beginners

- How to Lower your Life Insurance Premiums

- Roth IRA Stock Investing Tips to Build Wealth

My Favorite Tools

To help you reach your financial goals in your 20s, below are resources you can use to get started. Most are free to sign up and will support your money goals.

Leave a Reply